Investor Overview

AMG offers shareholders a unique opportunity to invest, at scale, in a diverse array of growing and cash-flow-generating independent investment firms through a proven partnership approach. Our Affiliates offer differentiated strategies across private markets, liquid alternatives, high-value equity, and multi-asset strategies.

Our strategy centers on making equity investments in growing, partner-owned firms, and collaborating with and investing alongside these firms to enhance their ongoing evolution. Having partnered with independent firms for 30 years, we have applied our unique and unmatched experience in developing powerful strategic capabilities – including business development support, growth capital, product development, distribution, and succession planning – to magnify our Affiliates’ long-term success while preserving their distinct entrepreneurial cultures and independence. Through an investment in AMG, shareholders access the growth of this diverse set of high-quality independent managers offering distinctive return streams in areas of secular demand, with strong long-term investment track records.

Our business generates significant discretionary capital; we deploy that capital through growth investments in new and existing Affiliates, and consistently return excess capital to shareholders as appropriate, including through share repurchases and our quarterly cash dividend. Making disciplined capital allocation decisions to create shareholder value is fundamental to our culture and our strategy.

Stock Information

Data Provided by Refinitiv. Minimum 15 minutes delayed.

| Growth Rates | |||||||

|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | '20-'21 | '21-'22 | |||

| AUM ($bn) | $716.2 | $813.8 | $650.8 | 14% | (20%) | ||

| Average AUM ($bn) | $664.4 | $761.7 | $709.4 | 15% | (7%) | ||

| Consolidated revenue | $2,027.5 | $2,412.4 | $2,329.6 | 19% | (3%) | ||

| Aggregate Fees | $4,626.4 | $5,611.4 | $5,560.5 | 21% | (1%) | ||

| Financial Performance Measures | |||||||

| Net income (controlling interest) | $202.2 | $565.7 | $1,145.9 | NM** | NM** | ||

| Earnings per share (diluted) | $4.33 | $13.05 | $25.35 | NM** | 94% | ||

| Supplemental Performance Measures* | |||||||

| Adjusted EBITDA (controlling interest) | $795.3 | $1,045.6 | $1,053.8 | 31% | 1% | ||

| Economic net income (controlling interest) | $621.7 | $770.0 | $797.2 | 24% | 4% | ||

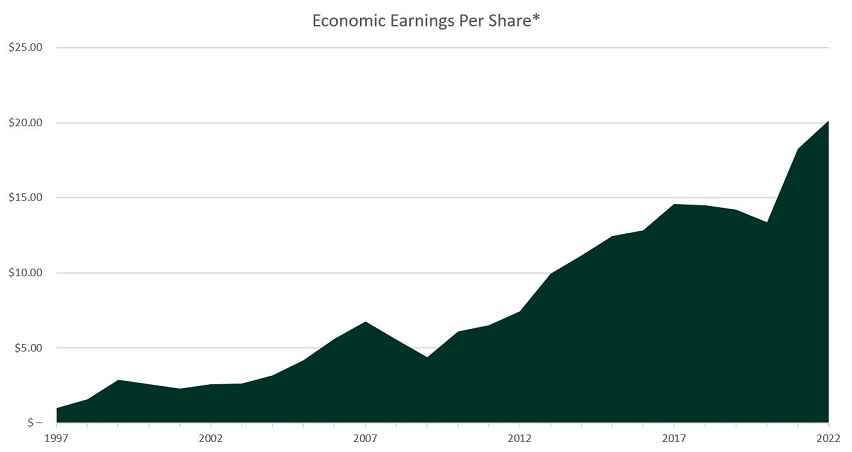

| Economic earnings per share | $13.30 | $18.05 | $20.02 | 36% | 11% | ||

| Debt | $2,312.1 | $2,490.4 | $2,535.3 | 8% | 2% | ||

| Credit rating (Moody's / S&P) | A3 / BBB+ | A3 / BBB+ | A3 / BBB+ | ||||

Note: Data in millions, except where noted or per share data.

*As supplemental information, we provide non-GAAP performance measures of Adjusted EBITDA (controlling interest), Economic net income (controlling interest), and Economic earnings per share. Management utilizes these non-GAAP performance measures to assess AMG’s performance before our share of certain non-cash expenses and to improve comparability between periods. These non-GAAP performance measures are provided in addition to, but not as a substitute for, Net income (controlling interest), Earnings per share (diluted), or other GAAP performance measures. For additional information on our Supplemental Performance Measures, including the impact of a definition change on these measures in the first quarter of 2023 and reconciliations to GAAP, see our Quarterly Report on Form 10-Q filed with the SEC on May 8, 2023, which is accessible on the SEC’s website at www.sec.gov.

**Percentage change is not meaningful.